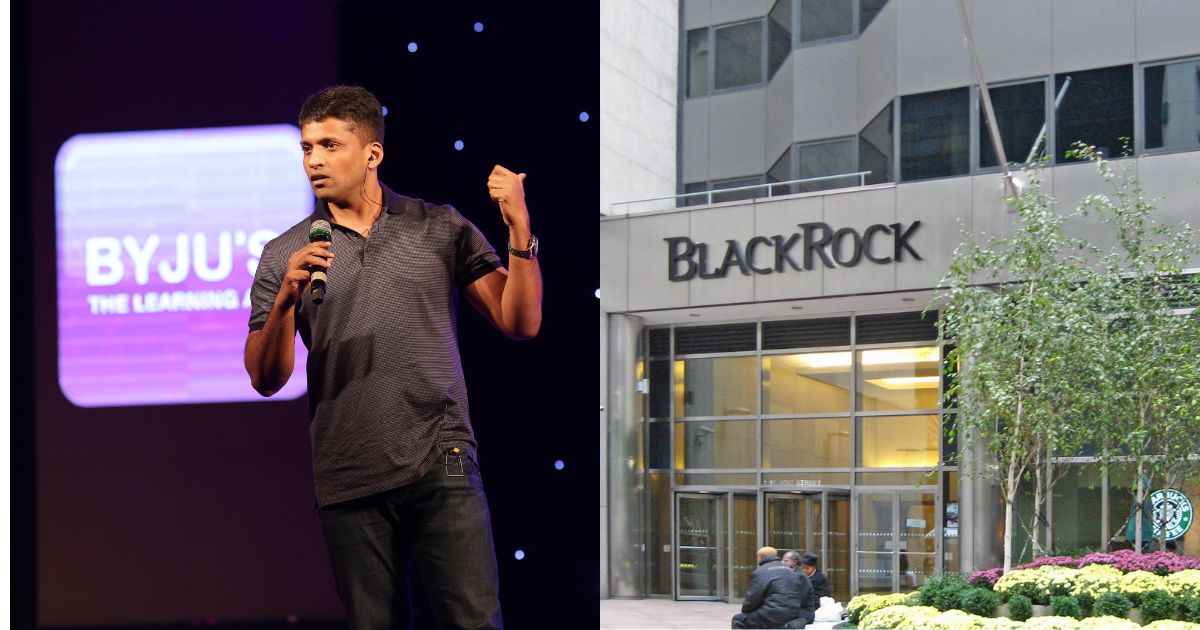

BlackRock slashes Byju’s valuation to $1 billion amid ongoing challenges

12 Jan 2024

In a recent disclosure by US-based asset manager BlackRock, the valuation of its stake in ed-tech giant Byju’s has been further reduced to approximately $1 billion, marking a significant 95% decrease from its peak valuation of $22 billion in 2022, reported TechCrunch on Friday, 12 January 2024.

This markdown coincides with a challenging period for Byju’s, grappling with issues ranging from the quest for fresh capital to delays in financial reporting and legal disputes with lenders. BlackRock, in October 2023, had valued Byju’s shares at around $209.6 each, a stark drop from the pinnacle of $4,660 in 2022.

An email inquiry to Byju’s regarding this valuation adjustment remained unanswered at the time of reporting. Sources indicate that BlackRock’s stake in the company is now under 1%, and the valuation process varies among investors.

This isn’t the first time BlackRock has devalued its investments in Byju’s. In 2023, the asset manager revised the valuation to approximately $8.4 billion, according to its filing with the Securities and Exchange Commission (SEC) for the March quarter. Prior to that, in December 2022, BlackRock had lowered the startup’s valuation to $11.5 billion.

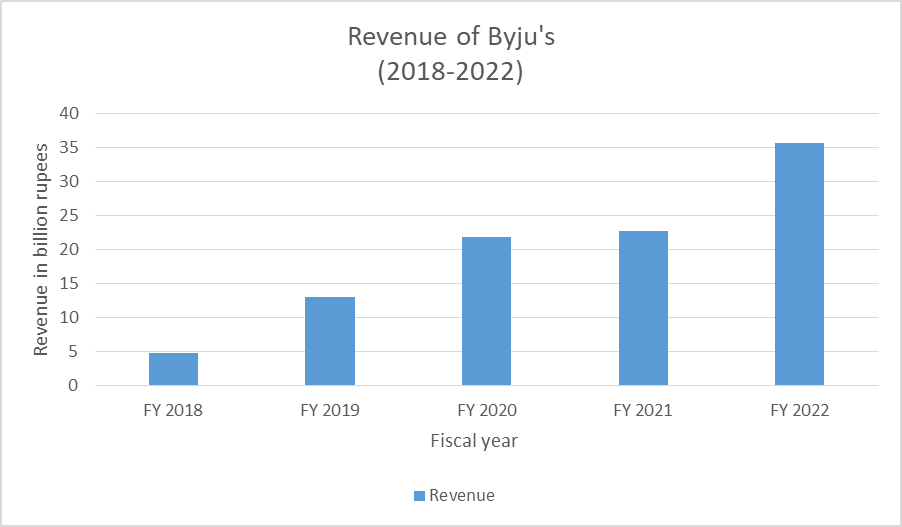

Byju’s has reported strong numbers in their revenue for the past four years, but recently their numbers have started to dwindle. Please refer to the chart below.

As you can see from the chart, Byju’s started with 4.9 billion rupees in revenue in 2018, which rose to 13.06 billion rupees in 2019. Since the pandemic, Byju’s has seen a tremendous rise in its revenue, amounting to 35.69 billion rupees in 2022.

Byju’s, which attained a valuation of $22 billion in March 2022 after securing $800 million from investors, has been facing a series of setbacks. The company is actively seeking additional funding to address financial commitments, operational needs, and legal disputes with lenders, sources say. It also confronts the challenge of substantially reducing losses to establish a sustainable long-term business model.

In November 2022, Byju’s Chief Financial Officer (CFO), Ajay Goel, departed from the firm, while Byju’s General Counsel, Roshan Thomas, resigned in January 2023. The company has been grappling with internal control issues, a topic of concern during its annual general meeting in December 2023, where shareholders pressed for transparency on financials.

Byju’s parent company, Think & Learn, reported consolidated losses of about Rs 8,245 crore in FY22, a notable increase from the Rs 4,564 crore in the previous period. WhiteHat Junior, a coding startup acquired by Byju’s in 2020, contributed significantly to these losses.

The company’s restructuring efforts, led by CEO Arjun Mohan, include changes in leadership and finance functions. Pradip Kanakia has been appointed as a senior advisor, and Nitin Golani as India Chief Finance Officer (CFO). Think and Learn reported a 2.3-fold increase in its core business income for 2021–22, showing signs of improvement amid financial challenges.

Byju’s, aiming for profitability by March 2023, reported delays in filing FY22 results with the Ministry of Corporate Affairs, and expected to be submitted soon.

This downward revision by BlackRock adds to a series of valuation cuts by investors, including Prosus NV and Baron Capital Group, reflecting the broader challenges facing the once high-flying ed tech giant Byju’s.